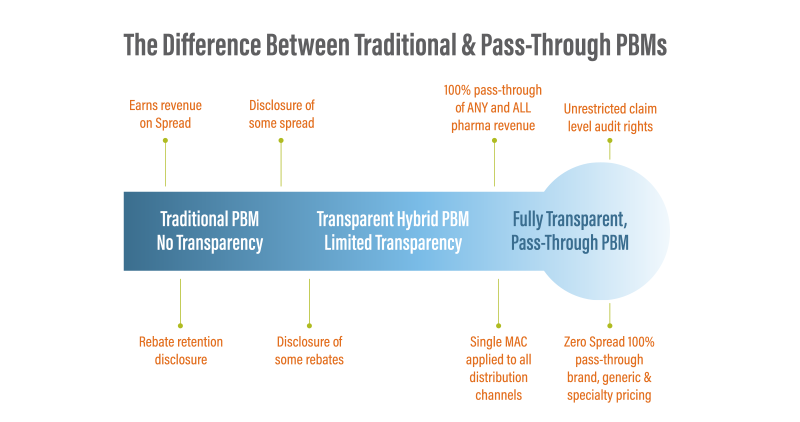

Some pharmacy benefit manager (PBM) contracts are filled with hidden costs. To get full visibility into all costs, such as pharmacy and manufacturer contract fees/charges, plan sponsors should partner with a transparent PBM.

Each one is different and their amount of transparency depends on their business model, which can impact your costs.

| PBM Models | ||

| Traditional: Somewhat transparent | Hybrid: More Transparent | Pass-through: 100% transparent |

Is Transparency a Financial Model?

In our opinion, no. Transparency is a way of doing business. It means full operational and financial disclosure and in the context of PBMs it means that all revenue streams are disclosed/revealed. Significant differences exist between a traditional, hybrid and a fully transparent pass-through model. Knowing the differences can help plan sponsors save on their pharmacy benefit costs. Here’s a quick look at the various PBM models and how they operate.

The key is in aligning your PBM’s goals with your goals. When they align, great things can happen.

What is spread?

According to Drug Channels Institute, spread is the difference between“… the amount a PBM charges to a plan sponsor and the amount the PBM pays to the pharmacy that dispenses the drug to a consumer”.1 In a traditional arrangement, the PBM may take a spread (also known as margin or mark-up) and charge the plan sponsor more than the pharmacy was paid. In a pass-through arrangement, the PBM bills the plan the same price it paid to the pharmacy.

Why should I be concerned about spread?

If you’re working with a traditional PBM, chances are you’re paying too much. The reason? It’s spread. Unfortunately, this happens with rebates and in other areas, too. Here’s a look at the long list of traditional PBM pricing practices:

- Retail spread

- Mail-Order spread

- Specialty pharmacy spread

- MAC list spread

- Rebate chasing

- Hidden non-disclosed fees

What are the different levels of access to claims data?

Depending on your PBM's model you may have anywhere from little to total access into your claims data. Here are the different access levels for each PBM model.

Traditional model:

Some visibility to and disclosure of PBM business practices on how they generate revenue and what they do with it. Typically, sample sets of data are provided for reporting/auditing purposes.

Hybrid model:

More visibility to and disclosure of business practices, with a varied degree of transparency. Typically shares a limited set of data for claim and invoice auditing.

Pass-through model:

100% visibility to financial and operational business practices. Plan sponsors have access to 100% of their data, and have visibility down to the claim/invoice.

Transparency is important because when you have access to all of your data you can make informed plan decisions, and it enables you to better monitor PBM performance and results.

Working with a completely transparent, pass-through PBM allows you to:

- Better understand your true total costs

- Monitor your overall performance and results

- Make informed decisions to manage costs

- Fine-tune formulary, network and utilization management components

Want to know more? Download our e-book:

7 things you need to know about pharmacy benefit management (PBM) models!

1 The 2018 Economic Report on U.S. Pharmacies and Pharmacy Benefit Managers, Drug Channels Institute, page 134, https://drugchannelsinstitute.com/products/industry_report/pharmacy/ (As viewed on 01/2019)