Why the model matters?

When it comes to pharmacy benefits, today’s plan sponsors are demanding more transparency, greater accountability and higher performance. One way you can achieve this goal is to choose a PBM model that lines up with your goals. If your goal is to lower cost, then you’re not alone. In a survey of employers with 5,000 or more employees, stated their top concerns were “related to controlling costs and the use of cost-effective treatments.” 1 Let’s take a look at the three models available.

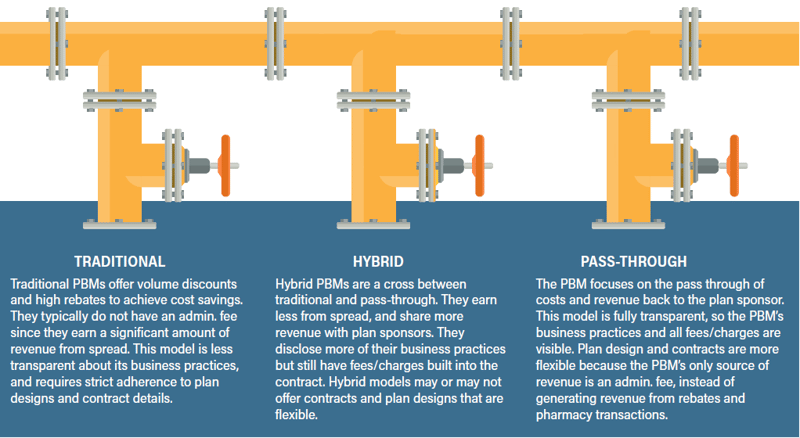

What models are available?

Traditional Model

Traditional PBMs offer volume discounts and high rebates to achieve cost savings. However, they may retain spread compensation from pharma revenue on rebates, discounts and incentives. They also may earn spread from pricing through various channels (i.e. retail, mail, and specialty). They may share some of the pharma revenue with the plan sponsors, but, with little to no transparency plans can’t get visibility into how much the PBM is keeping. Additionally, traditional PBMs offer guarantees on savings, but they may place a cap on the amounts, so they can retain the difference. However, some plans sponsors prefer a traditional PBM model since it offers performance guarantees that may serve as a safety net to prevent Rx costs from going out of control.

Hybrid MODEL

Hybrid models combine traditional and pass through to offer a slightly more transparent option, allowing visibility into pricing and revenue business practices. To provide a little more give and take, some channels (i.e. retail, mail and specialty) may be pass through while others may contain spread. A hybrid model may also share some pharma revenue such as rebates, discounts and incentives) with plan sponsors. But again, transparency is limited leaving little visibility into how much the PBM keeps. Hybrids may charge a minimal admin. fee or none at all.

pass-through MODEL

Pass-through PBMs offer the most transparency among PBM models. They pass 100% of all rebates and discounts back to the plan sponsor. Pass-through PBMs can do this since their only source of revenue is an admin fee. With that said, they typically provide full financial and operational disclosure and offer full audit rights down to the claim and invoice level so plan sponsors can verify the savings. Additionally, they focus on lowering overall drug spend with the right drug mix and selective rebates, to help plans achieve better drug trend and a low PMPM.

WANT TO KNOW MORE?

Download our e-book: 7 things you need to know about pharmacy benefit management (PBM) models!

1 TOWARD BETTER VALUE, National Pharmaceutical Council (NPC), Page 4, https://www.npcnow.org/publication/toward-better-value (As viewed on 01/2019)